Averages are meaningless.

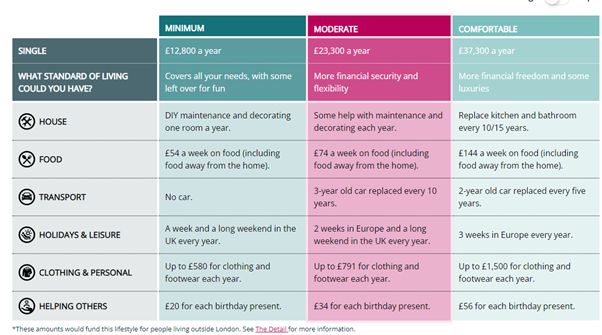

Never-the-less here's a chart I found of various incomes in retirement and what the average person could use their income for. It's a year or so out of date now after so many price rises.

The average income of a single pensioner was £246 a week between 2020 -2021.

I'm eternally grateful that Colin loved his County Council Bridge Inspecting job and they give me a spouses pension because of his death. I have a savings bond using the downsizing money and those and my state pension means my income is in between minimum and moderate.........although closer to the minimum.

Have to say that £54 a week on food seems a lot, my spending is less than that and I see that those on minimum income are not expected to have a car - they all must live somewhere with public transport! because the majority of people in villages and countryside have no alternative. £580 for clothes and shoes is way more than what I spend too - thankfully.

Some people think I worked until 1980 and then never worked again, so have been retired for 40 years already! Not quite true. It is true that I never had a full time paid employment outside of home after eldest daughter was born. My library assistant salary was way down the pay grades and I really didn't like being bossed about by the new young graduate librarian anyway, so it seemed sensible to stay at home and find ways to save money. Which, by never wasting a penny, growing food and watching all the spending, we achieved. Every now and again I did some part time work that fitted in around the children.

I have.........

- Cleaned a house

- Cleaned a village hall

- Grown herbs to sell at the PYO fruit farm

- Picked fruit on the fruit farm for their freezers

- Saturday Library assistant job

- Been an after school and holiday childminder

- Run a small home based nursery group

- Been a lunch time school playground supervisor in a primary school

- and in a Middle school

- Sold herbs at a WI Country Market

- Census enumerator

- Poll Clerk on election days

And all the time we were doing up houses and moving up the housing ladder.

Then after moving to the smallholding I had animals and the campsite to look after and vegetables, fruit and herbs to sell and for several years we bought and sold country themed books at local country fairs and I also sometimes made cards and cakes for a WI Country Market.

Although my retirement isn't as planned...... Colin dying aged 61 didn't come into any retirement thoughts .............I seem to be managing well and actually have spare pennies for those coffees out and second hand books.

I realise I'm one of the lucky pensioners that are so disliked by many!

Back Tomorrow

Sue

I got told once as a pensioner I had no right to travel when so many others were struggling!

ReplyDeleteI have never understood why well managed is regarded as lucky, nor why 'lucky' should be disliked. Make the most of your skills and assets, and enjoy your reserves.

ReplyDeleteI don't understand why pensioners who have worked hard and saved for their retirement are disliked - One can only assume it's a form of jealousy. Enjoy the fruits of a retirement you have worked hard for.

ReplyDeleteI'm grateful for my home, food and clothing. After many years on "minimum to moderate" income, I don't expect foreign holidays every year. Quite amused by the "3 year old car replaced every 10 years" - my Toyota is 15years old, and won't last much longer. And what does "£20 for each birthday present" mean? Some of us have more siblings and grandchildren than others. I guess, as you say, this is an "average".

ReplyDeleteI agree that those of us born at the tail end of the Baby Boom had great advantages - eg a full university grant, but that's no justification for other people to dislike us. Some of the OAPs I know are among the most generous people around, even though they are not particularly affluent.

Thank you for this Sue, I feel very blessed to have a good pension from my teaching, although saying that I worked in some awful school some years so jolly well deserve it.. But because I had some very lean years after my divorce I am quite good at saving and living frugally.

ReplyDeleteMy personal opinion is that pensions, taxes, contributions etc should be taught at school, one or two lessons in the fifth form would be very useful for many.

ReplyDeleteI also, like Chris, have my teacher's pension which is a jolly good scheme, plus the state pension and a little extra from an old AVC that goes straight into savings each month. I earned a lot of what I have (and my Mum and Dad earned the rest, bless them). I say I am fortunate, and in many ways I am, but it didn't just happen, any more than yours did.

ReplyDeleteI haven't come across any jealousy from my younger friends but I'm sure it does exist in some people. Retirement can seem a long time away and if you are not happy in your employment, it might be hard to see us living the life of leisure, forgetting that we've been there too, we weren't born older and retired.

Their turn will come, albeit later than previous generations. xx

I love the suggestion that being on a good pension income would mean you could change your bathroom or kitchen every 10 years. Who would want the disruption, not to mention the expense of doing that? Probably just as well that I won't be in that category 😁

ReplyDeleteNot there yet, but heading towards the middle minimum to moderate and will be quite happy with that.

My kitchen is still the one that was already old when we moved in over 20yrs ago. Perhaps a more frugal attitude is a significant factor in pensioners being seen as better off than the young?

ReplyDeleteThe thing is you are not lucky, Colin worked for his pension, you both worked your way up housing ladders and downsized to be comfortable in retirement, that's not luck, you both worked for what you are benefitting now, as did so many of us. I hate being told I'm lucky, I came form nothing as did hubby, no family fortunes passed to us, we are self-made and worked hard.

ReplyDeleteLike you, Im on a single state pension, widowed in my early 50’s so nearly 20 years now. I do run a car, 10 years old but don’t take any holidays or buy meat or alcohol, so it equals out. Living in a very small village I’m fortunate enough to have lovely walks with a borrowed dog, plenty of inexpensive village activities, the library and an abundance of friends. I don’t know anyone with a pension in the top bracket. Sarah Browne.

ReplyDeleteIt astonishes me how some working people spend what they have, wasting it on every consumer fad: bathrooms, kichens, personalised car number plates on luxury cars being examples. Will they be the ones to complain of being poor in old age?

ReplyDeleteWill go out on a limb here. I think people in the Uk over the age of 65 are, generally speaking, more fortunate than people who are now in their 20. For the following reasons:

ReplyDelete1. Free university education and a non repayable grant, if parents income was below a threshold… meaning one could graduate from university with no debt

2. Much more affordable house prices (consider average wage to average house price)

3.Triple lock on state pension

4. And if female and born before April 1953 being able to draw a state pension at 60!

All women born after April 1950 did not get their pension at 60.

DeleteBorn 1955 pension at 66

DeleteI was born in 1952 and I had to wait till 62 for my pension. I worked and made the threshold for a full pension unfortunately because I retired before a certain date I receive a lower rate losing out on a heafty part of the new pension.

DeleteMea culpa…I stand corrected. even so pension at 62

DeleteWe didn't have cheaper homes back in the 70"s and 80's - prices were relevant to wages back then too.

DeleteWe also had interest rates at 15% + and inflation at 20% +. People, today make me smile when they moan about the mortgage rate being 5% - they've still got it lucky at 5%

Anne

These tables never seem to apply to anyone. It's rather like the 'average' shopping basket.

ReplyDeleteGood points from Traveller! As a new retiree, my teacher's pension is well below the minimum although when I reach 67 in 10 years I'll get my State pension as well and hit the minimum bracket. Lucky is subjective depending on your circumstances. My parents were the 'lucky generation' in that they bought a house for very little and it's now worth 10 times what they paid in 1978. They worked hard for their pensions so deserve their 'luck.' I think nowadays as people live longer, pension planning needs to be addressed in your 20s and not wait (like me!!) until you're older to think about it.

ReplyDeleteI won't say you were lucky I would say you worked hard to provide for you and your family and are now getting the minimum you deserve having paid into the system. As yet I don't know how much pension I will be getting but having been promised being able to retire at 60 having to wait until I am 66, having worked since I was 18, feels like a kick in the teeth.

ReplyDeleteI've always admired your careful ways with what you have, luck doesn't come into it in my opinion.........

ReplyDeleteAlison in Wales x

Born before April 1953 I got my pension at 62 along with most of my school chums. The pension transition away from 60 had already begun and we were all in that window.

ReplyDeleteI have just added that comment above Rachel before I read your comment.

DeleteI stand corrected. Didn’t get pension until age 62 if born before 1953, but the main issues are still house affordability and not ending university with a significant amount of debt.

DeleteThe harder we worked the luckier we were. Both from Council houses and my husband learned a trade and I went to college. We are grateful to have each other and one grown up daughter whom we help where we can. Catriona

ReplyDeleteI agree with the earlier poster who commented that domestic finance should be routinely taught. It's better to know the mechanics of money and planning, particularly if you don't have much!

ReplyDeleteI'm also surprised at the idea of regularly redecorating and redoing a room. My own haven't seen that for a long time!

You've managed very well and due to this, you retired to a lovely comfortable life. Some seem not to think about the future retirement. Being unprepared makes life difficult. I can not imagine how difficult, especially today, when everything is high cost.

ReplyDeleteThanks everyone above for comments!

ReplyDeleteReally, i think it all comes down to one thing. The same thing. You knew how to live within your means. In my own experience, I see a lot of young people who have never learnt that. If you cannot tailor your expenses to your income while you are working, you will never be able to do it when you are retired. Unfortunately that is a situation that cannot be fixed. No matter how much money you make, it will never be enough. I am so grateful for our practical life.

ReplyDeleteBetween Minimum and Moderate - that's where I've spent my life!

ReplyDeleteAs pensioners here across the pond, we saved all that we could. This was so we could travel when we wanted to, and be able to spend how we wish. Still live within our means though.

ReplyDeleteGod bless.

Interesting post. Husband turned 60 this year and we're starting to think seriously about retiring in a few years. It seems a little scary, but I like to think we could make the leap. He'd like not to wait until 70 (which is what they push for here). It seems lately we've heard of too many couples who have lost a spouse early with hardly a chance at retirement. We're hoping that we can supplement the retirement income with perhaps a part-time money earner of some kind.

ReplyDelete